A state’s budget is also a list of its most pressing priorities – here’s what the ACLU of New Jersey is urging government leaders to include for FY25.

Reproductive Freedom

The ACLU-NJ is committed to ensuring reproductive health care, including abortion, is accessible for all New Jerseyans regardless of race, gender identity, sexual orientation, immigration status, income, or insurance, and continues to center the experiences of patients and providers in the fight for reproductive justice.

Even though New Jersey took the crucial step of reaffirming and protecting the right to abortion by passing the Freedom of Reproductive Choice Act, which codified the constitutional right to abortion in the state, much more must be done.

For FY25, the ACLU-NJ is calling for continued funding to support abortion providers and expand abortion care coverage for uninsured and underinsured communities across the state.

Reinvestment of Cannabis Revenue in Communities Harmed by the Drug War

New Jersey legalized cannabis with the promise of investing almost 60 percent of all cannabis sales tax revenue and 100 percent of the Social Equity Excise Fee in communities most harmed by the criminalization of marijuana. As those funds continue to accumulate, state-elected leaders must include New Jerseyans in the decision-making process so that communities can decide how the revenue should be allocated to best prioritize their needs.

For FY25, the ACLU-NJ and partners are asking for more transparency and accountability in the budget process, including more opportunities for community input and a public tracker that shows how funds are allocated. In addition, we want to ensure that this revenue is not used to fund the criminal legal system. Instead, it should be used to fund community resources, like housing, education, and harm reduction programs.

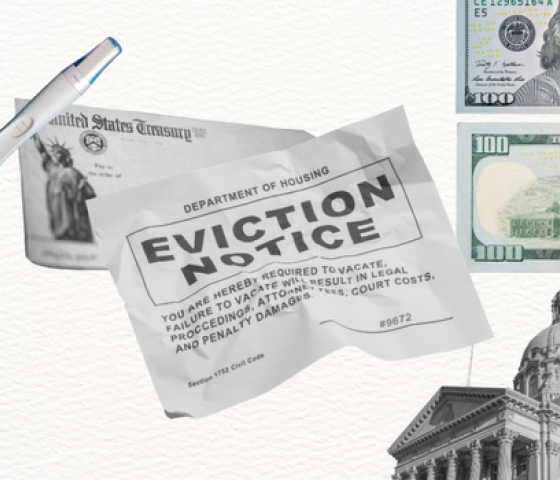

Right to Counsel

Access to housing is a fundamental right. As New Jerseyans continue to grapple with rising rent costs and decreasing availability of affordable housing, it is vital that New Jersey implement policies that will allow tenants to stay in their homes.

Economic barriers often result in tenants being unable to afford a lawyer for housing proceedings, and with the COVID-19 protections no longer in place, tenants are left with little recourse in landlord tenant court, where the odds are stacked against them. Recent national statistics indicate that landlords are represented by attorneys nearly 81% of the time, while tenants are only represented 3% of the time.

Providing tenants facing eviction with legal representation is an important policy intervention that will ensure families can stay in their homes and prevent many of the long-term harms associated with eviction, such as disrupting education, job-loss, damage to physical and mental health, and difficulty finding new housing. These harms are disproportionately experienced by Black and Latinx people, especially women and children, making eviction a matter of racial justice and gender equality.

For FY25, the ACLU-NJ is calling for an increase of $20 million to further fund the Comprehensive Eviction Defense and Diversion Program within the DCA’s Office of Eviction Prevention.

Strengthening Immigrants’ Rights by Ensuring Legal Representation

New Jersey’s system of legal representation for detained immigrants facing deportation is one of the most vital programs in our state. The Detention and Deportation Defense Initiative has provided legal representation to hundreds of low-income detained people who are routinely denied access to due process within the federal immigration system. In the program’s first year, individuals represented through the program were three times more likely to win release than those without representation.

For FY25, the ACLU-NJ is calling for an increase in funding from $8.2 million to $10.2 million to provide legal representation to immigrants facing detention and deportation.

Making the Corporate Business Tax Surcharge Permanent

The corporate business tax is New Jersey’s third-largest source of tax revenue, which supports vital investments – like public transportation, infrastructure, and public schools – that make the state an attractive place to raise a family or start a business. By allowing the corporate business tax surcharge to expire, New Jersey gives the biggest and most profitable corporations, including multi-national companies headquartered outside of the state, a tax cut worth $1 billion per year at the expense of essential programs that provide access to opportunity for all New Jerseyans.

For FY25, the ACLU-NJ and the For the Many Coalition are calling for the corporate business tax surcharge to be made permanent.

Take Action for a Budget that Reflects Our Values

Contact your lawmakers today and tell them to build a budget that embodies liberty and justice for all. There is no better time than the present for New Jersey to prioritize equity.